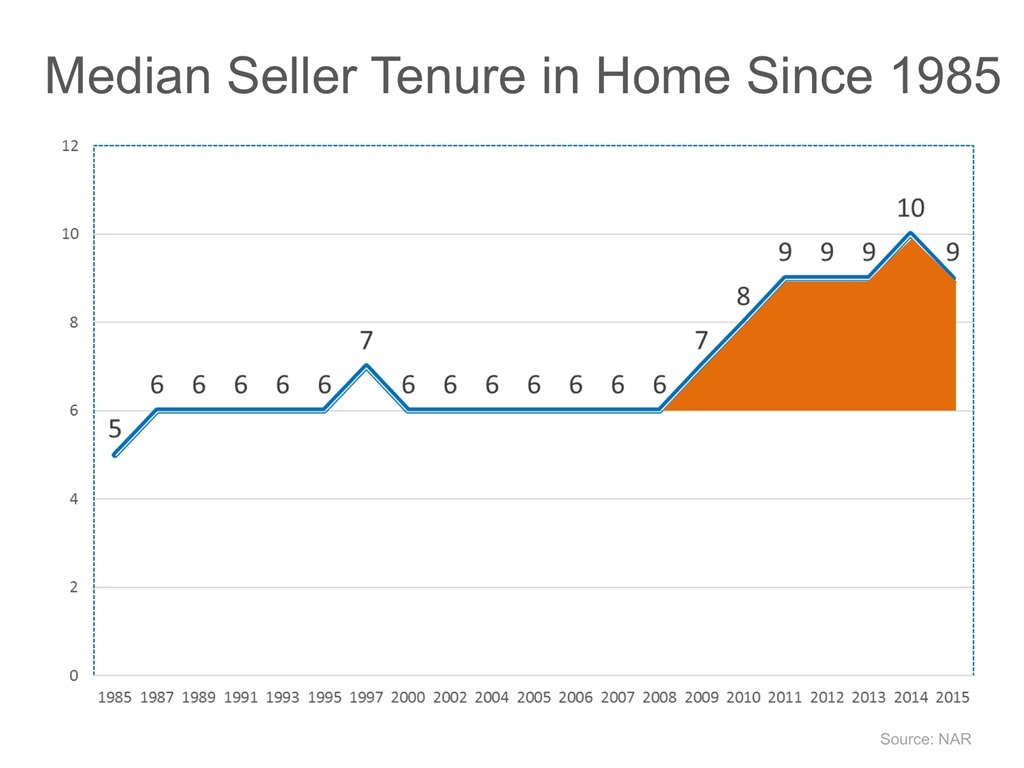

The National Association of Realtors (NAR) keeps historic data on many aspects of homeownership. One of the data points that has changed dramatically is the median tenure of a family in a home. As the graph below shows, for over twenty years (1985-2008), the median tenure averaged exactly six years. However, since 2008, that average is almost nine years – an increase of almost 50%.

Why the dramatic increase?

The reasons for this change are plentiful. The top two reasons are:

-

The fall in home prices during the housing crisis left many homeowners in a negative equity situation (where their home was worth less than the mortgage on the property).

-

The uncertainty of the economy made some homeowners much more fiscally conservative about making a move.

However, with home prices rising dramatically over the last several years, over 90% of homes with a mortgage are now in a positive equity situation with 70% of them having at least 20% equity.

And, with the economy coming back and wages starting to increase, many homeowners are in a much better financial situation than they were just a few short years ago.

What does this mean for housing?

Many believe that a large portion of homeowners are not in a house that is best for their current family circumstances. They could be baby boomers living in an empty, four-bedroom colonial, or a millennial couple planning to start a family that currently lives in a one-bedroom condo.

These homeowners are ready to make a move. Since the lack of housing inventory is a major challenge in the current housing market, this could be great news.