2016 was an interesting year, with massive surprises including the Trump presidency, Brexit, and a stock market that continues to grind higher to new all-time records. How these events and the events ahead might ultimately impact home values is beyond my crystal ball; but I do have some FUNDAMENTALS to share with you. Please feel free to share this analysis to anyone who might benefit.

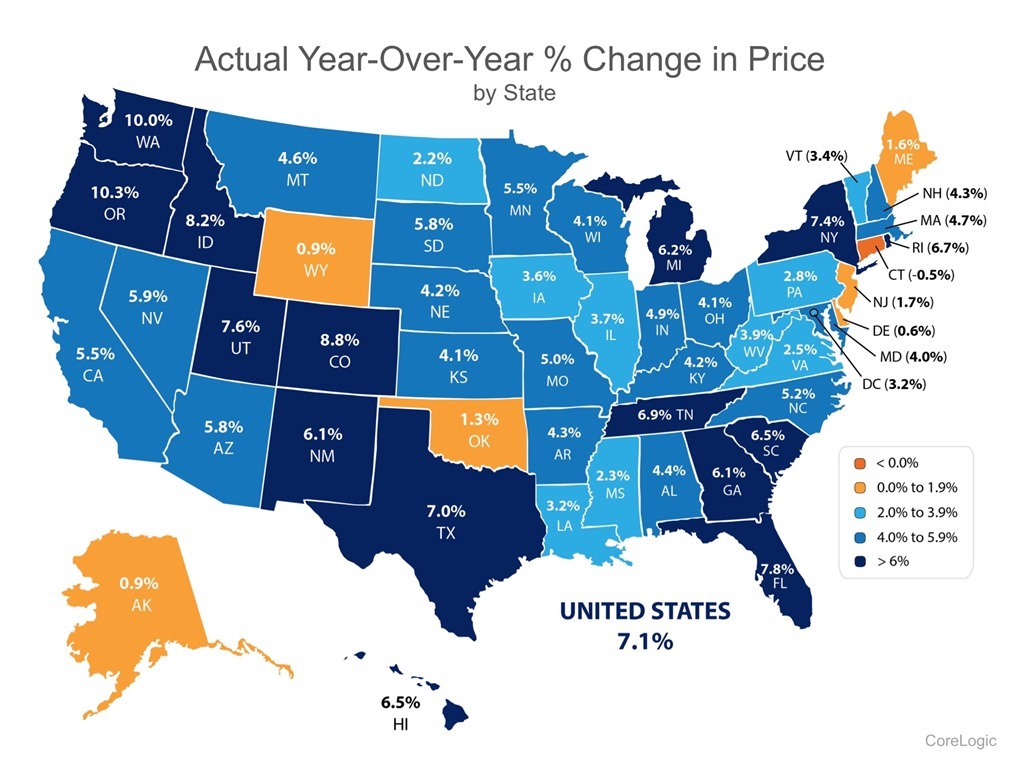

Last year, U.S. housing was up 7.1% nationally. That is an incredibly strong national number considering we are nearly 10 years into the recovery.

Think about it this way – if you bought a $250k home with 5% down payment in December 2015, your annualized return on investment was 142%. That’s right, your $12,500 down payment is your investment, but the entire $250k home appreciated 7.1%. That is the magic of owning real estate; not only does your cash down payment appreciate, the entire value of the property appreciates.

Will housing continue to appreciate?

If you ignore the noise out of the media and look at the fundamentals, it looks like demand will continue to outpace supply in the years ahead.

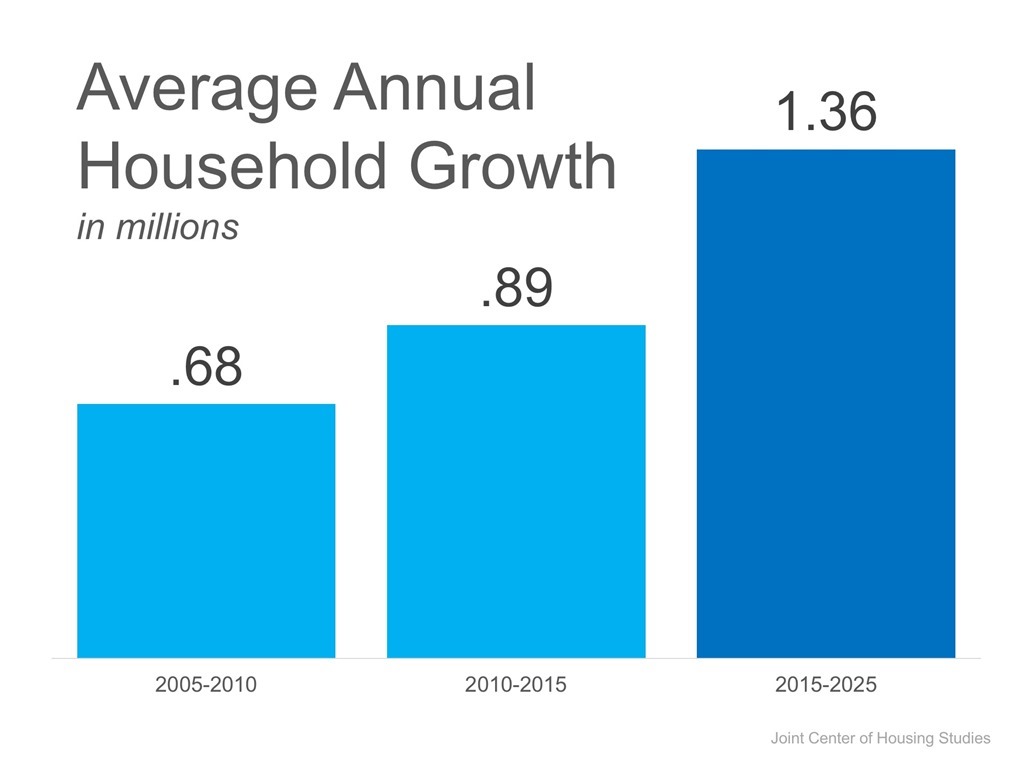

The Joint Center of Housing Studies just came out with its household formation report. Between 2005 and 2010 the U.S. averaged 680,000 new households per year (net migration into the U.S. and kids moving out on their own forming new households). From 2010 to 2015 that number grew to 890,000 new households. Between 2015 and 2025 momentum will build with an estimated 1,360,000 new households per year.

Where are all these new households going to live? Sure, some of them will rent, but eventually everyone tires of annual rent increases and the neighbor’s hip hop music at 2am…

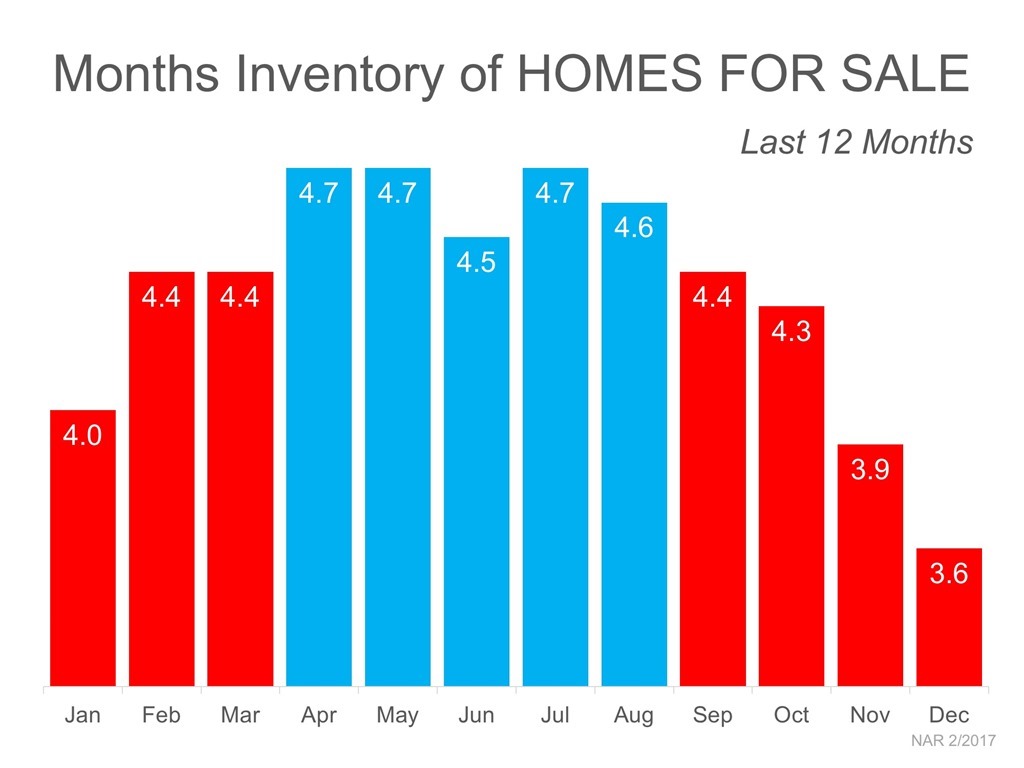

Each year between now and 2025 the U.S. will add 1.36M new households, in addition to the previously formed households, they will continue to fight for the best real estate in our local communities. We are already seeing this take shape, take a look at the national supply of homes for sale, any reading under 6 months’ supply is considered low inventory (supply), we are below 4 months currently, which is extremely low supply of available housing.

So what does this mean?

It means beyond the noise in the media, the FUNDAMENTALS point to more potential buyers and increased demand between now and 2025. This comes at a time where supply is already extremely low. My guess is your return on investment might not be 142% annually going forward, but it’s likely to do pretty well.

If you, your family, colleagues or friends have questions about buying or selling your home in todays market, I would be honored to help and invite you to contact me. You can call or text me directly at 801-390-8423, anytime!