Yesterday, I reported that according to CoreLogic’s latest Equity Report, nearly 268,000 homeowners regained equity and are no longer underwater on their mortgage in the first quarter. Homes with negative equity have decreased by 21.5% year-over-year.

A study by Fannie Mae suggests that many homeowners are not aware of how their equity position has changed as their home has increased in value.

For example, their study showed that 23% of Americans still believe their home is in a negative equity position when, in actuality, CoreLogic’s report shows that only 8% of homes are in that position.

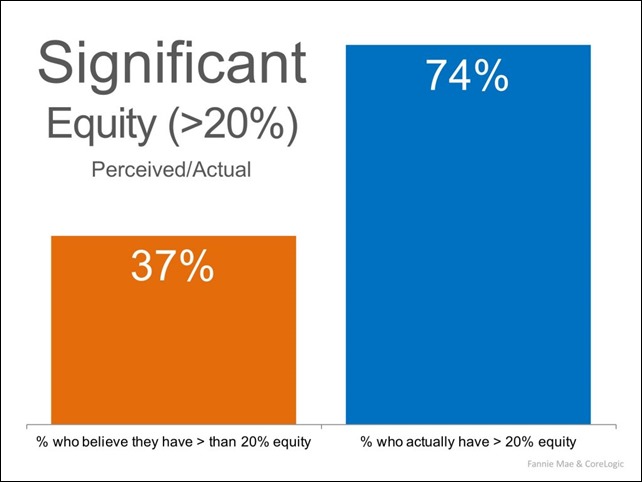

The study also revealed that only 37% of Americans believe that they have “significant equity” (greater than 20%), when in actuality, 74% do!

This means that 37% of Americans with a mortgage fail to realize the opportune situation they are in. With a sizable equity position, many homeowners could easily move into a housing situation that better meets their current needs (moving to a larger home or downsizing).

Fannie Mae spoke out on this issue in their report:

“Homeowners who underestimate their homes’ values not only underestimate their home equity, they also likely underestimate: 1) how large a down payment they could make with their home equity, 2) their chances of qualifying for mortgages, and, therefore, 3) their opportunities for selling their current homes and for buying different homes.”

CoreLogic’s report also revealed that if homes were to appreciate by an additional 5%, over 800,000 US households would regain positive equity.

Bottom Line

If you are one of the many homeowners who is unsure of your current equity situation, let’s meet up to discuss your options.